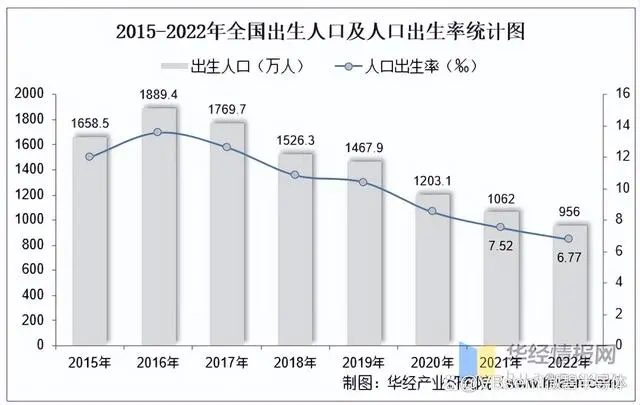

According to the data from the seventh national census, the population aged 0-14 accounts for 17.95% of China's population; those aged 15-59 make up 63.35%; and those aged 60 and above constitute 18.70%, with those aged 65 and above accounting for 13.50%.

Moreover, from 2019 to 2022, the population aged 20-30 decreased from 235 million to 215 million annually, while the population aged 35-45 increased from 219 million to 228 million. It is evident that China's population is seriously aging.

Especially given the current sharp decline in the birth rate, delaying retirement has become a topic of discussion. Coupled with the extension of average life expectancy, the reality of elderly individuals still having income is emerging. Elderly people may become the main force in consumption.

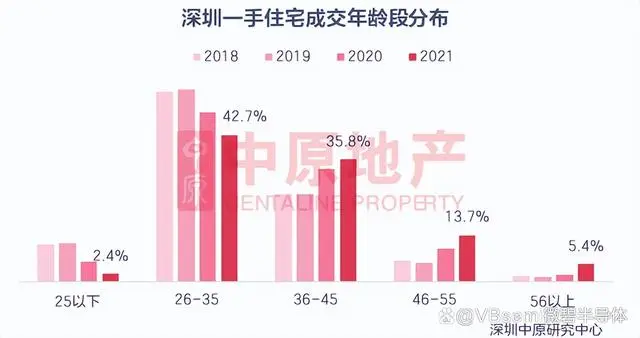

The biggest expense for ordinary people is often buying a house. Given the national context, purchasing a house is basically something every family will face, with the only difference being where and when to buy. Buying a house requires consideration of down payment and loans, which are a huge challenge for an ordinary family, especially in first and second-tier cities where the down payment is high, leading to the trend of older ages among homebuyers in such cities.

According to data from the Shenzhen Zhongyuan Research Center, the average age of homebuyers in Shenzhen has been increasing from 2018 to 2021.

As the age of homebuyers increases, with many people buying homes in their 40s, it's unlikely that many will be able to take out a 30-year mortgage. This increases the pressure on the down payment. Consequently, a vicious cycle is formed where the down payment is insufficient when young, and when the down payment is sufficient, the mortgage term is not long enough.

According to the "Fourth Quarter 2022 Financial Institution Loan Allocation Statistics Report" released by the People's Bank of China, the annual increase in real estate loans in 2022 was 721.3 billion yuan, accounting for only 3.4% of the incremental loans during the same period. In 2021 and 2020, this proportion was 19.1% and 26.3%, respectively.

In this situation, multiple real estate developments in Nanning have announced externally that "the age limit for mortgage loans can be extended to 80 years old," and several banks in Nanning have also confirmed the existence of such a policy, with some banks already implementing it.

Many marketing executives from major real estate companies such as Datang Real Estate, Long Guang Real Estate, Silverlight Real Estate, and Greenland Group have stated that they are aware of this policy, with some companies explicitly stating that they are "following up." In the near future, several of their main projects will launch similar mortgage policies in collaboration with partner banks.

This policy has attracted the attention of many older individuals. Previously unable to get a mortgage for a house, they can now apply for a mortgage with a term of at least 20 years under the new mortgage policy, which has sparked some interest among those who previously found the mortgage term insufficient.

With multiple policy boosts, such as mortgage rate cuts and increases in housing provident fund loan quotas, the Nanning property market has shown signs of recovery.

According to data from the Nanning Municipal Housing and Urban-Rural Development Bureau's official website, from January 21 to January 27 this year, the number of signed contracts for commercial housing transactions in Nanning increased by 415.79% compared to the same period last year, and the transaction area increased by 638.13%.

Since the signed data does not include newly subscribed data, the Nanning Housing and Urban-Rural Development Department conducted market research. The results of the survey show that from January 21 to 27, 2023, 103 commercial projects in Nanning City received 2,889 visits, and 332 sets of commercial housing were sold, with a transaction area of approximately 36,000 square meters. The actual transaction volume is much larger than the signed data.

Since the beginning of 2023, many cities including Huaibei, Yichang, Jining, Shaoxing, Jinan, Dandong, Bozhou, and Dalian have increased the housing provident fund loan quotas. At the same time, multiple cities continue to implement housing subsidy and preferential policies, including Jiyuan, Harbin, Nanjing, Nanchang, Changsha, Yancheng, and Xuzhou.

Currently, two banks in Ningbo have adjusted the borrower's age limit to 80 years old, and several banks have recently extended the borrower's age limit. With this trend, it is believed that the policy of extending the borrower's age limit to 80 years old will also be implemented nationwide.

But how many people will choose to pay off their mortgages for a lifetime? Thinking about the latter half of one's life, even after retirement, one still has to consider the monthly mortgage payment before doing anything else. How can one truly enjoy their later years?

Feel free to share your thoughts on this matter.

* 如果您需要申请我司样品,请填写表格提交,我们会24小时内回复您