The trend of semiconductor de-globalization is obvious, and the mature process chip domestic substitution has ushered in a rare window of opportunity. With the historical opportunities of energy reform and the rapid development of domestic electric vehicle industry, power devices represented by MOSFETs will lead the process of domestic substitution acceleration. It is expected that by 2026, the domestic substitution rate of MOSFETs will exceed 60%.

The development of power devices is relatively mature, and there has been no theoretical innovation for many years. The gap between domestic enterprises and international leading enterprises is gradually narrowing. This trend is particularly evident in MOSFET devices, where technology and structures are relatively fixed, and domestic enterprises have also been deeply cultivating for many years, with sufficient experience accumulation. Therefore, in the next few years, the domestication rate of power devices represented by MOSFETs will increase significantly, and the increase rate will be ahead of most semiconductor products.

Terminal market and trends

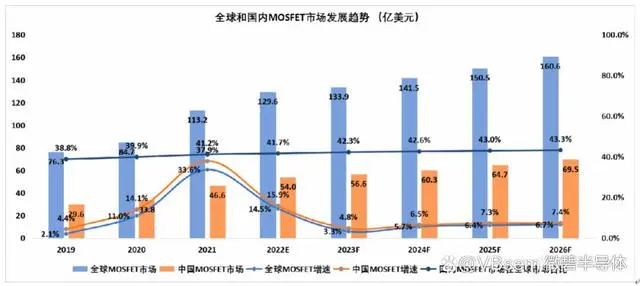

In 2021, the global MOSFET market size surpassed $10 billion for the first time, reaching $11.32 billion, with a growth rate of 33.6%. During the same period, the domestic market was $4.66 billion, with a growth rate of 37.9%, higher than the global level. The main reason is that the rapid development of the domestic new energy vehicle industry has brought new product application scenarios.

In the next few years (2022-2026), the global MOSFET market will continue to grow. After the growth rate fell to 3.3% in 2023, it will slowly rebound, and the market size will reach $16.06 billion by 2026. During the same period, the growth of the domestic MOSFET market will be slightly higher than the global level, and the domestic market size will reach $6.95 billion by 2026. With the continuous rapid growth of the domestic MOSFET market, the proportion of the Chinese market in the global market will also continue to increase, from 41.2% in 2021 to 43.3%.

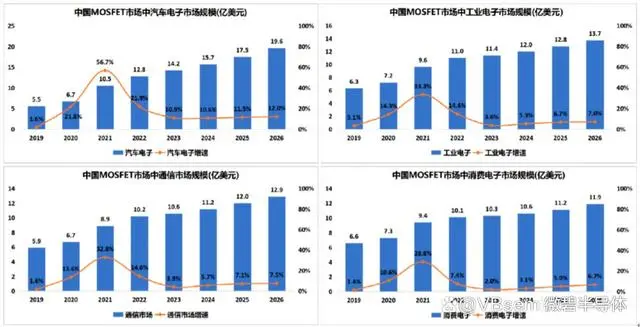

Automobiles (including charging piles), industrial, consumer (including home appliances), and communication markets are the four main application segments of MOSFETs. In 2021, affected by chip shortages and price increases, the growth rates of various sub-segments all exceeded 25%, with the MOSFET market in the automotive sector growing by 56.7%.

In the next few years, the automotive market will continue to lead in growth among the four segments, mainly driven by the rapid development of the domestic new energy vehicle industry.

Sub-segment product market and trends

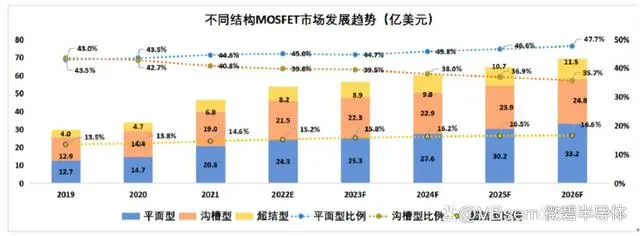

In 2021, the market shares of planar, trench, and super junction were 44.6%, 40.8%, and 14.6%, respectively. From the perspective of market size, the planar, trench, and super junction MOSFET markets will continue to grow. The main reason is the development of the Internet and the electronic information industry, where more products are moving towards electronic terminals. A typical example is the transformation of automobiles into electrification, networking, and intelligence, becoming one of the terminals with the most chips used individually.

From the proportion in the MOSFET market, under the trend of changes in demand for high-voltage MOSFETs due to the carbon neutrality and the conversion of AC to DC, the demand for high-voltage MOSFETs will continue to increase, and the planar and super junction markets will benefit, and their market share will continue to increase. Due to the downturn in the consumer electronics market, the growth rate of the trench MOSFET market is lower than that of the planar and super junction, leading to a gradual decrease in market share from 40.8% in 2021 to 35.7% in 2026.

In 2021, the market shares of medium and low voltage, high voltage, and ultra-high voltage were 63.1%, 26.4%, and 10.5% respectively, with medium and low voltage market occupying a large market share. From the perspective of market size, the medium and low voltage, high voltage, and ultra-high voltage MOSFET markets will continue to grow in the next few years.

From the proportion in the MOSFET market, the demand for high-voltage and ultra-high-voltage MOSFETs will continue to increase, and their shares will continue to rise. The growth rate of medium and low voltage MOSFETs is lower than that of high-voltage and ultra-high-voltage, resulting in a gradual decrease in market share from 63.1% in 2021 to 53.8% in 2026.

As mentioned earlier, planar MOSFETs are a type of product with easily adjustable parameters and wide applications. The operating voltage can cover medium and low voltage, high voltage, and ultra-high voltage. In 2021, in the planar MOSFET market, the market shares of medium and low voltage products were 50%, while high voltage and ultra-high voltage accounted for 34.6% and 15.7% respectively. From the trend of market share development, the market share of medium and low voltage is decreasing, while the market shares of high voltage and ultra-high voltage are increasing, consistent with the overall MOSFET market.

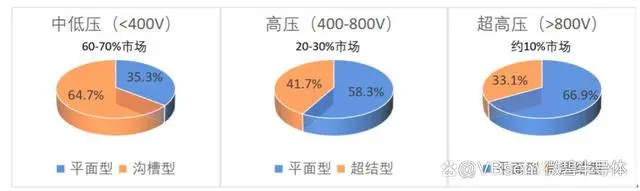

Market Share of Different Structures in Various Voltage Segments.

Market shares of different structural markets in different voltage segments in 2021 are as shown. This proportion will basically remain unchanged in the next few years.

Domestic substitution process

In 2021, the market size of China's MOSFET market reached $4.66 billion, and the domestic substitution rate reached 30.5%. It is expected that with the acceleration of domestic substitution, by 2026, the domestic substitution rate of MOSFETs will reach 64.5%.

In terms of structure, the domestic substitution rates of planar and trench MOSFETs are higher than that of super junctions. By 2026, the domestic substitution rates of the three will reach 68.7%, 66.6%, and 47.9% respectively, all of which have increased by about 30% compared to 2021.

From the perspective of voltage segments, the domestic substitution of the medium and low-voltage segment is leading compared to the high-voltage and ultra-high-voltage markets, reaching 82.7%, 46.2%, and 21.5%, respectively, by 2026. Among them, the domestication rates of the medium and low-voltage and high-voltage segments have increased significantly compared to 2021, with increases of 46.9% and 23.3%, respectively, while the domestication rate of the ultra-high-voltage segment has only increased by 6.3%.

In the planar MOSFET market in 2021, the domestication rates of the medium and low-voltage, high-voltage, and ultra-high-voltage segments were 42.2%, 29.9%, and 18.2%, respectively. It is expected that by 2026, the domestication rates of the medium and low-voltage, high-voltage, and ultra-high-voltage segments will increase to 85%, 67.4%, and 44.4%, respectively.

Pain Points of Domestic Substitution:

Domestic enterprises mainly rely on VDMOS for planar MOSFETs, lacking low-power products with high cell density.

Domestic manufacturers have significant gaps in efficiency, performance, reliability, and compatibility between high-voltage and ultra-high-voltage MOSFETs compared to leading companies such as Infineon.

There is a lack of truly automotive-grade MOSFET devices domestically, and one of the reasons for this situation is that automotive companies do not verify, support, and only want to directly use chips that have been validated.

Most MOSFET companies in China are relatively small in scale, and their participation in global competition is insufficient, with weak resilience to market fluctuations.

Key Enterprises:

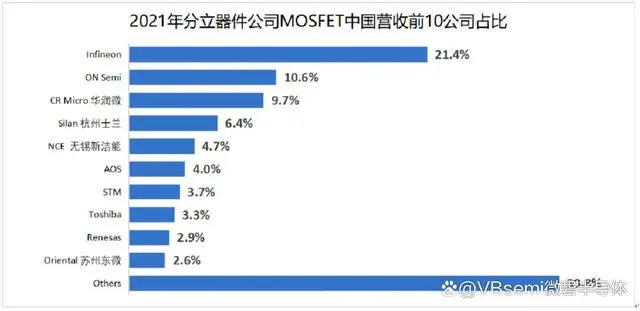

Currently, in the domestic MOSFET market, Infineon still holds more than 20% of the market share relying on a comprehensive product layout. Among the top ten manufacturers, four domestic companies have already made the list, forming a basic breakthrough.

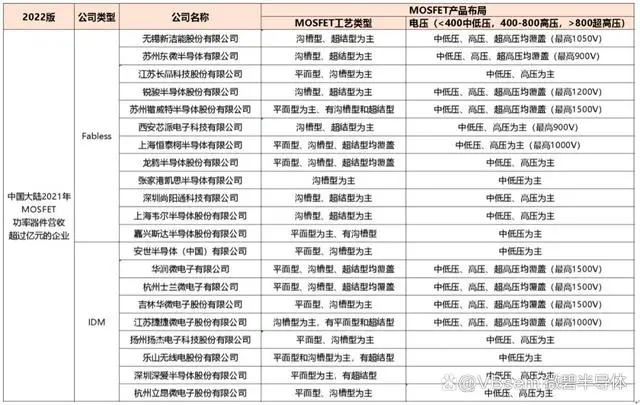

There are nearly a hundred well-known MOSFET device manufacturers domestically, with 21 companies having a scale of over 100 million RMB. From the perspective of voltage segments, these 21 companies basically produce medium and low-voltage MOSFETs, while companies with technologies for ultra-high-voltage MOSFETs of over 1000V are relatively few, and there are also fewer types of high-voltage products.

Wafer capacity is the foundation for the survival and development of chip companies. Currently, there are eight wafer production lines capable of power device foundry domestically, mainly including HHGrace Semiconductor, Shanghai Jita Semiconductor, and SMIC Shaoxing, with a total existing capacity of approximately 367,500 wafers/month (equivalent to 8 inches) and a total planned capacity exceeding 546,600 wafers/month (equivalent to 8 inches). At the same time, wafer fab capacity will be adjusted according to actual demand, so the capacity aspect can basically meet the needs of domestic Fabless companies in the next few years.

International situation will accelerate the domestic substitution of power devices. Since the US sanctions against Huawei in May 2019, the globalization, division of labor, and cooperation of semiconductors have been greatly impacted. Domestic substitution has been put on the agenda of corporate development. With the passage of the "Chip and Science Act" by the United States on August 9, 2022, the semiconductor industry will develop towards a multi-regional, multi-ecological, and competitive pattern. As a result, the domestication rate of mature process semiconductor chips represented by MOSFET power devices will rapidly increase in the next few years.

* 如果您需要申请我司样品,请填写表格提交,我们会24小时内回复您