People who are concerned about technological development often come across various information about semiconductors, especially regarding the bottleneck technology that our country faces. However, most people actually do not understand the semiconductor industry. Today, let's briefly introduce the semiconductor industry.

Looking at the entire industry chain structure, the upstream of semiconductors includes supporting industries such as semiconductor equipment and components, semiconductor materials, etc. The midstream includes chip design, manufacturing, and testing, while the downstream includes various application fields such as consumer electronics, communications, artificial intelligence, new energy, data centers, and the Internet of Things.

In terms of semiconductor product production, it mainly includes front-end design, back-end manufacturing, packaging testing, and finally entering the consumer market. Different manufacturers are responsible for different stages, and each stage is interrelated, ultimately integrating chips into products and selling them to users.

Semiconductor manufacturers are also divided into two main categories: IDM (Integrated Design and Manufacture), which includes the entire process of design, manufacturing, and testing, such as companies like Intel, TI, and Samsung; and Fabless, which only focuses on design while outsourcing chip processing and testing to professional wafer foundries, such as Huawei's HiSilicon, Spreadtrum, Qualcomm, MTK (Taiwan MediaTek), etc.

Front-end design is the "soul" of the entire chip process, starting from receiving customer requirements, then proceeding to specifications, system architecture design, solution design, programming, software testing, submitting netlists for chip layout, and finally providing layouts to wafer foundries for processing. Due to different processes, engineers responsible for front-end design need to familiarize themselves with the process library provided by the foundry almost six months in advance, and try different layout designs to output the patterns that the foundry wants.

Back-end manufacturing is the "foundation" of the entire chip process. After receiving the layout, companies like TSMC, which are wafer foundries, start the lithography process, layer by layer, to eventually process the chips into bare dies.

Packaging testing is the "tail" of the entire chip process. The chips processed by the wafer fab are bare dies with no packaging. From the wafer image, you can see a shiny circular thing with many lines drawn on it, and many small squares cut out. That is the bare die.

Bare dies cannot be integrated into smartphones. They need to be packaged externally, and the chips are connected to PCB boards with gold wires so that the chips can work properly.

Companies in the semiconductor industry are mainly divided into four categories:

One type is IDM, namely Integrated Device Manufacturers: They not only design and sell microchips but also operate their own wafer production lines. Examples include Intel, SAMSUNG, Toshiba, STMicroelectronics, Infineon, and NXP.

The other type is Fabless, namely Non-Wafer Suppliers: These companies develop and sell semiconductor devices on their own but outsource chip production to independent wafer foundries. Examples include VBsemi (Microgreen), Altera, Atmel, Broadcom, Cirrus Logic, Lattice Semiconductor, NVIDIA, PMC-Sierra, Qualcomm, Ferroelectric, Sun Microsystems, Xilinx, Huawei's HiSilicon, Spreadtrum, MTK (Taiwan MediaTek).

There are also wafer foundries, Foundries: They have their own wafer production lines and provide manufacturing services to other companies. Examples include TSMC, UMC.

Virtual Component Suppliers only develop integrated packages and authorize them to be integrated into ICs by other companies. Examples include ARM, Sci-worx, and Synopsys.

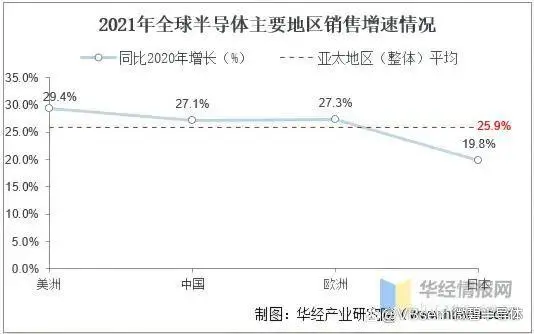

With the rapid development of downstream demand areas such as artificial intelligence, big data, cloud computing, the Internet of Things, automotive electronics, and consumer electronics in the semiconductor industry, the global semiconductor industry's prosperity has rebounded, with the market size experiencing the largest growth in recent years in 2021. Data shows that the global semiconductor industry's sales reached $555.9 billion in 2021, an increase of 26.2% compared to 2020.

The Americas market saw the largest increase in sales in 2021, with semiconductor sales in the Americas increasing by 27.4%. China remains the largest single semiconductor market, with total sales of $192.5 billion in 2021, an increase of 27.1% year-on-year. Semiconductor sales in the European market increased by 27.3%, sales in the Asia-Pacific region/all other regions increased by 25.9%, and sales in the Japanese market increased by 19.8%.

Since its development, the global semiconductor industry landscape has been continuously changing. Currently, the global semiconductor industry is undergoing the third capacity transfer, with the industry demand center and capacity center gradually shifting to mainland China.

* 如果您需要申请我司样品,请填写表格提交,我们会24小时内回复您